Join 250,000+

professionals today

Add Insights to your inbox - get the latest

professional news for free.

Join our 250K+ subscribers

Join our 250K+ subscribers

Subscribe27 MAR 2025 / ACCOUNTING & TAXES

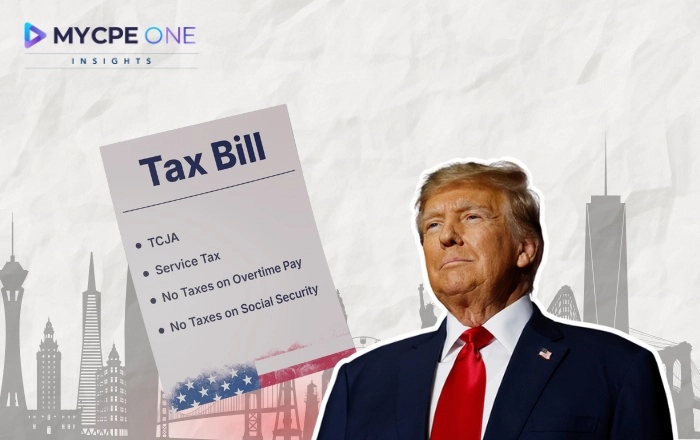

Congress is preparing for a major showdown over proposed tax cuts that could permanently extend the 2017 Tax Cuts and Jobs Act (TCJA), potentially lower corporate tax rates to 15%, eliminate taxes on overtime pay, and remove taxes on Social Security benefits, among other measures. With a warning from billionaire investor Ray Dalio about "dire" risks of increasing national debt, the proposed tax cuts, which could cost around $4.5 trillion over the next decade, have sparked concerns about possible spending cuts, loophole plugging, or manipulations in budget rules to offset the costs.

Congress is back in town, and they’re not just here to shake hands and pose for photos. They’re gearing up for what might be the wildest tax showdown since the original 2017 cuts. Think of it as TCJA 2.0, but with way more fireworks, tighter budgets, and a warning from none other than Ray Dalio. The billionaire investor cautioned lawmakers this week about the "dire" risks of spiraling deficits, urging them to rein in the national debt before it crushes future government spending. As House and Senate Republicans lock horns over just how deep these tax cuts should go, and how to pay for them, the stakes couldn’t be higher.

Let’s rewind for a sec. Back in 2017, the Trump administration rolled out the Tax Cuts and Jobs Act (TCJA), a beast of a bill that slashed the corporate tax rate from 35% to 21%, trimmed individual rates, and capped the SALT deduction at $10,000. The bill gave businesses a big ol’ tax break, and for many Americans, their paychecks saw a little boost too. But here’s the kicker: many of those benefits, especially for individuals, are set to expire at the end of 2025. Cue the scramble.

Republicans are looking to lock in some serious tax relief, permanently. But with a national debt already flexing at historic highs, it’s not all sunshine and slashed rates.

Here’s what’s on the table:

In line with this push, Trump also announced a 25% tariff on imported cars and car parts, a move that aligns with his broader strategy to boost domestic manufacturing and bring supply chains home.

Here’s where things get spicy. The GOP is facing a major math problem: how to fund tax cuts that cost trillions.

“It lets you lie about what you are doing,” warned Marc Goldwein of the Committee for a Responsible Federal Budget. Others, like Kent Smetters from Wharton, fear it could signal to markets that the U.S. has given up on deficit control.

Big Winners:

On the Losing End:

This isn’t just a political showdown, it’s a major shake-up that will ripple across tax planning, investments, and wealth strategies. Here’s what finance professionals should keep tabs on:

As PwC’s Rohit Kumar puts it, “They’re going to have to make some choices… and put in some revenue limits.”

Ray Dalio’s warning echoes a broader concern shared by economists, rating agencies, and even bond markets: if Congress keeps slashing without trimming elsewhere, the U.S. could be speeding toward a fiscal cliff with the top down. Whether this tax bill becomes a legacy-defining victory or just another budget-busting mess, one thing’s for sure, it’s going to reshape how we think about taxes, debt, and economic growth in America. Want more updates like this? Subscribe to our newsletter for real-talk insights on tax, policy, and the financial stories shaping the future.

Until next time…

Don’t forget to share this story on LinkedIn, X and Facebook

📢MYCPE ONE Insights has a newsletter on LinkedIn as well! If you want the sharpest analysis of all accounting and finance news without the jargon, Insights is the place to be! Click Here to Join

Unlimited CPE for Just $199/Year!

Get CPE credits by reading or listening to approved content. Enjoy unlimited CPE for CPA (US), EA, CMA, CIA, CFE, SHRM, HRCI, and 100+ other designations—all for just $199 per year! (Learn More)

Team Subscriptions Available – Starting at Just $199/Year!

Schedule a no-obligation call