Join 250,000+

professionals today

Add Insights to your inbox - get the latest

professional news for free.

Join our 250K+ subscribers

Join our 250K+ subscribers

Subscribe17 JUL 2025 / ACCOUNTING & TAXES

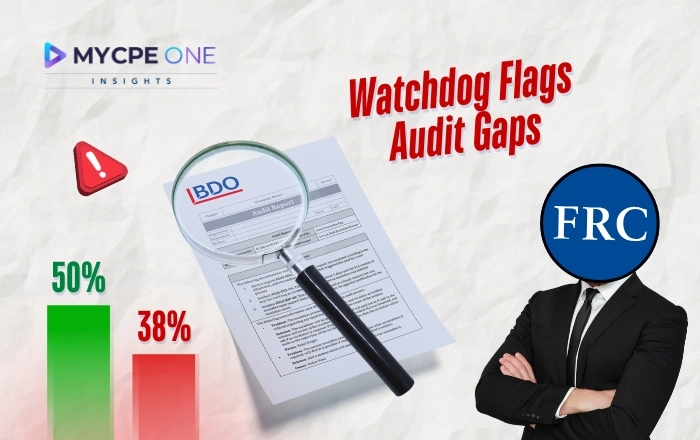

The UK-based accounting firm BDO's audit quality has been criticized by the Financial Reporting Council (FRC), with the watchdog stating that it "significantly fell short of expectations". Despite BDO's aggressive expansion, the FRC's report showed 30% of the firm's audits required significant improvements, whereas fellow mid-tier firm Forvis Mazars achieved a 90% pass rate.

“You don’t get to sit with the cool kids just because you bought new shoes.” That’s the message UK regulators just handed BDO, the mid-tier accounting firm itching to crash the Big Four party. While BDO’s ambition to secure more public interest audit clients has been loud and proud, its audit performance has just been called out, hard, by the Financial Reporting Council (FRC). The UK’s accounting watchdog says BDO’s latest audit work still “significantly fell short of expectations.” In the latest FRC audit quality inspection, 50% of BDO’s audits were rated as needing no more than “limited improvement.” Better than last year’s dismal 38%, sure. However, it still places BDO last among its peers, including fellow mid-tier firm Forvis Mazars, which achieved a 90% pass rate. So, what’s really going on behind the curtain? And can BDO clean up its act before regulators bring down the hammer?

BDO has been aggressively expanding in the Public Interest Entity (PIE) market, which includes listed companies, banks, and insurers, hoping to nibble away at the Big Four’s turf. It now audits the third-highest number of PIEs in the UK. But the FRC’s findings put a major dent in that breakout strategy. Out of 14 BDO audits reviewed by the FRC (pulled from a pool of 206 that were in scope), four audits, nearly 30%, required significant improvements. In the regulator’s speech, that’s a red alert. The core issue? Deficiencies in auditing financial statements, particularly in how BDO evaluates revenue recognition, asset impairment, and risk assessments. These aren’t minor technicalities—they’re bread-and-butter areas that can make or break a company’s financial truth-telling.

And this isn’t the first time. The FRC flagged “recurring underlying issues” in BDO’s audit work. Translation? Despite promises of improvement and a significant investment, the same problems persist, much like a bad penny.

BDO’s public response was polished: a new leadership team, fresh training initiatives, and big talk of “strategic refresh.” However, the FRC isn’t here for sound bites. It warned that “change must happen at pace” and said the firm will remain under close regulatory supervision. If BDO doesn’t clean up its act fast, it could face serious consequences under the PIE Audit Registration rules, including conditions, suspensions, or full-on registration removal. The FRC laid out its concerns plainly:

In other words: more receipts, less rhetoric.

Now, here’s the twist. While BDO’s performance is getting grilled today, it’s worth remembering that the Big Four aren’t exactly audit saints either. Remember Carillion, the construction giant that collapsed in 2018, blindsiding investors and sending shockwaves through Parliament? That was KPMG’s audit. How about Patisserie Valerie, where a £94 million accounting hole went unnoticed? Credit goes to Grant Thornton (not Big Four, but a bigger player than BDO). Then there’s Wirecard, Greensill, Thomas Cook, a veritable rogues gallery of audit failures, many involving Big Four firms.

What’s wild is that BDO hasn’t been tied to any of those massive blowups. So, while its current audit quality isn’t up to par, it hasn’t missed red flags that caused billion-dollar collapses either. Silver lining? Maybe. But in the audit world, even small missteps can snowball fast.

Here’s the cheat sheet BDO probably has taped to their boardroom whiteboard:

It’s not rocket science, but execution is where things have gone sideways before.

Mark Shaw, who took over as BDO’s managing partner in October 2024, has a tall order. He’s brought in new senior leadership, promised better training, and emphasized “tech-enabled audit delivery.” That’s all great, but it’s the next round of inspections that’ll prove if it’s more than corporate spin. Meanwhile, Forvis Mazars is riding high, while the Big Four are coasting with audit quality of 90% or more, and BDO is sitting at the bottom of the review board. If mid-tier firms want a real shot at disrupting the oligopoly, it’ll take more than ambition. It’ll take clean audits, tight controls, and no room for repeat offenses. BDO’s not out of the race just yet, but the next few quarters are make-or-break. And the FRC? They’ve got receipts, rules, and a sharp eye on whoever’s next in the hot seat. Get the latest industry insights delivered straight to your inbox. Subscribe now!

Until next time…

Don’t forget to share this story on LinkedIn, X and Facebook

📢MYCPE ONE Insights has a newsletter on LinkedIn as well! If you want the sharpest analysis of all accounting and finance news without the jargon, Insights is the place to be! Click Here to Join

Digital Marketing Services for CPA & Accounting Firms - Starting $399/month.

Struggling to attract new clients? MYCPE ONE’s Digital Marketing Services help accounting firms stand out, generate leads, and grow revenue effortlessly.

With expertise in SEO, paid ads, social media, and targeted PPC, MYCPE ONE maximizes your marketing efforts to deliver high ROI and broader industry reach.

Invest in digital marketing for your firm today—see the difference with MYCPE ONE!

Stand out. Generate leads. Grow revenue.