Add External Credits

Easily add credits from external sources.

Certificate Vault

Your CPE Certificates at one place documented

Credit Reporting

Accurate reporting for all your credits

Audit Ready Report

Be audit-ready with one-click reports

Compliance Tracker

Easily track and manage your CPE Credits

Dashboard

Smart Dashboard with up to date tracking

Reminders

Stay informed with smart notifications

Review and Ratings

Trusted by 250K+ professionalsGet personalized help. Book a call with our Advisor

Schedule a No-Obligation 15-Min CallSelect your free trial plan, complete your details, and access a world of knowledge.

|

Pricing Plan

7-Day Free Trial

|

Silver

$199/ Year |

Gold

$299/ Year |

|---|---|---|

| 15,000+ Hours of CPE Content Largest content library covering all aspects of professional development. |

||

| 500+ Subject Areas Wide range of subject areas tailored to meet diverse learning needs of all the department of the firm. |

||

| 50+ State- Specific Ethics Courses Stay compliant with ethics requirements for every state. |

||

| 250+ Compliance Packages Pre-selected courses for quick compliance, saving time and effort. |

||

| 100+ Advanced Certification Programs Expert-led programs to build advanced expertise and strengthen your career credentials. |

||

| AICPA Eligibility Programs (CFF, ABV, PFS) Pre-Packaged Eligibility Courses for AICPA designations such as PFS, ABV, and CFF, offering CPE credits upon completion. |

||

| Compliance Tracker and Credit Vault Store all your certificates in one place, stay compliance-ready with ease, and track your progress effortlessly using the built-in credit tracker. |

||

| Mobile App Access (iOS and Android) | ||

| Instant Certification and Fast Reporting Instant reporting to IRS, CFP Board, and other governing bodies. |

||

| Practical Training Programs |

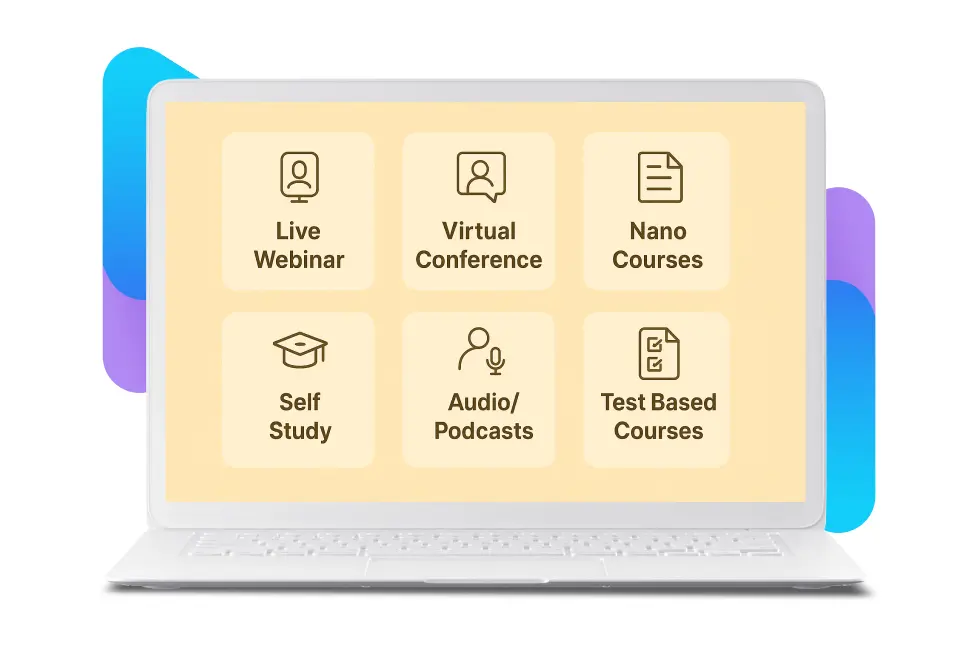

Your subscription gives you unlimited access to 15,000+ hours of content across 100+ qualifications — including ethics courses, live webinars, self-study, audio, and more. No hidden fees. One price, full access.

The subscription is valid for 12 months from the date of purchase. For example, if you subscribe on June 1, 2025, your access will continue until June 1, 2026.

Yes, if you choose auto-renewal, your plan will automatically renew each year at the same price unless you opt out. You’ll receive reminder emails before renewal.

Yes! Start with a 7-day free trial to explore all features and content. Cancel Anytime, No Obligations. (Users will not be able to download the certificates during the Free Trial)

No, subscriptions are non-transferable and tied to your personal profile to maintain your learning progress and compliance records.

Yes, the courses are approved by 25+ Regulatory Bodies including NASBA, IRS, CFP ® Board, SHRM, HRCI, and more. Our courses meet all required compliance standards.

We cover 100+ professional qualifications including CPA (US), EA, AFSP, CIA, CMA, CPA in Canada, CFP, CFE, SHRM, HRCI, CRTP, CPP, and more.

Yes, Ethics courses are included at no additional cost and are tailored to meet each qualification's requirements.

We continuously add new content weekly, including trending topics, regulatory updates, and new live webinars to keep you up-to-date.

Absolutely! Our mobile app is available on both Android and iOS, giving you access to all courses on the go. (Note: Exam Prep courses are currently not available via the app.)

Yes! Every completed course comes with a downloadable certificate from your profile — perfect for audits or license renewals.

Yes, our smart dashboard lets you track completed credits, download certificates, get reminders, and even add external credits for complete compliance tracking.

You can reach us via:

Live Chat the website

Phone: 646-688-5128 Email: support@my-cpe.com

Zoom Calls: Book a support call or advisory session anytime

Support is available Monday to Friday, 9 AM to 5 PM EST.